- 20 Marks

Question

Asasepa Ltd prepares its financial statements to 31 December each year until 31 December 2016, when the business changed its accounting date. The company prepared its next financial statements for 15 months to 31 March 2018.

At 1 January 2017, the following balances existed in the business’s accounting records:

- Plant and machinery: cost GH¢819,000; accumulated depreciation GH¢360,000.

- Motor vehicles: cost GH¢148,000; accumulated depreciation GH¢60,000.

Depreciation policy

The business’ policy on depreciation is to charge proportionate depreciation in the periods of purchase and sale of its non-current assets, charging depreciation as from the first day of the month in which assets are acquired, and up to the last day of the month before any disposal.

Annual rates of depreciation taken are:

- Plant and machinery: 15% straight line

- Motor vehicles: 25% straight line

Transactions during the year

During the 15 months ended 31 March 2018, the following transactions took place:

- 10 January 2017: An item of plant was purchased. The cost was made up as follows:

- Cost ex-factory: GH¢41,200

- Delivery: GH¢300

- Installation costs: GH¢800

- Construction of foundations: GH¢3,600

- Spare parts for repairs: GH¢4,000

- Cost of one-year maintenance agreement: GH¢2,000

- Total: GH¢51,900

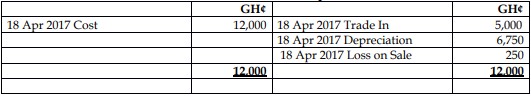

- 18 April 2017: A new motor vehicle was purchased for GH¢18,000. An existing vehicle which had cost GH¢12,000, and which had a book value at 1 January 2017 of GH¢6,000, was given in part exchange at an agreed value of GH¢5,000. The balance of GH¢13,000 was paid in cash.

Required:

a) Prepare the ledger accounts to show the balances at 1 January 2017.

b) Record the non-current asset transactions for the 15 months period ending 31 March 2018.

Answer

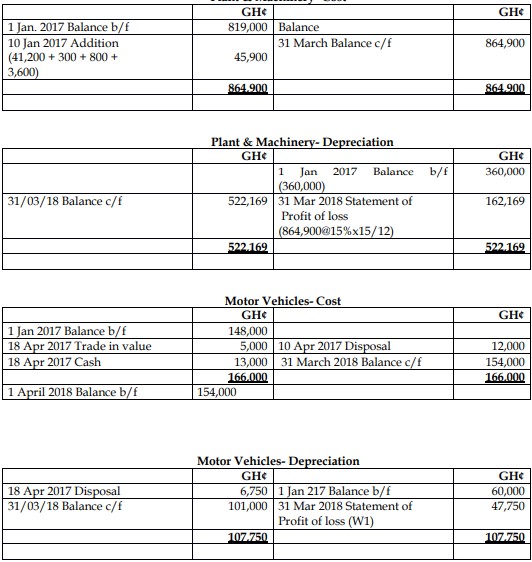

Plant & Machinery – Cost

Motor Vehicles – Disposal

Working:

Depreciation:

- (154,000 – 18,000) × 25% × 15/12 = 42,500

- 18,000 × 25% × 12/12 = 4,500

- 12,000 × 25% × 3/12 = 750

- Total = 47,750

- Tags: Depreciation, Disposal of assets, Ledger Accounts, Non-current Assets

- Level: Level 1

- Topic: Non-current assets and depreciation

- Series: MAY 2018

- Uploader: Theophilus