- 20 Marks

Question

The following trial balance was extracted from the ledger account of Bob & Sons, a sole proprietor, as at 31 December 2016:

Trial Balance as at 31 December 2016

| Account | Debit (GH¢) | Credit (GH¢) |

|---|---|---|

| Building, at cost | 650,000 | |

| Office equipment at cost | 135,000 | |

| Plant and Machinery | 263,500 | |

| Accumulated depreciation | ||

| – Building | 39,000 | |

| – Office equipment | 27,000 | |

| – Plant and Machinery | 65,875 | |

| Purchases | 248,000 | |

| Sales | 500,000 | |

| Inventory 1 January 2016 | 27,500 | |

| Discount allowed | 4,800 | |

| Returns inwards | 3,200 | |

| Wages and Salaries | 64,885 | |

| Rent | 5,580 | |

| Insurance | 6,000 | |

| Trade receivables | 145,000 | |

| Trade payables | 132,750 | |

| Provision for bad debt | 24,840 | |

| Bank overdraft | 58,956 | |

| Cash in hand | 5,400 | |

| Long-term loan | 350,000 | |

| Capital 1 January 2016 |

1,558,865 |

360,444

1,558,865 |

Additional Information:

i) Inventory as at December 2016 was valued at GH¢24,000.

ii) Insurance was paid for 15 months ending 31 March 2018.

iii) 3 months rent is outstanding. The agreed amount per month is GH¢620.

iv) Included in wages and salaries is an amount of GH¢2,500 withdrawn by the owner. Secondly, the cleaner has not been paid his salary for December 2016 as at the end of the year. His monthly salary is GH¢500.

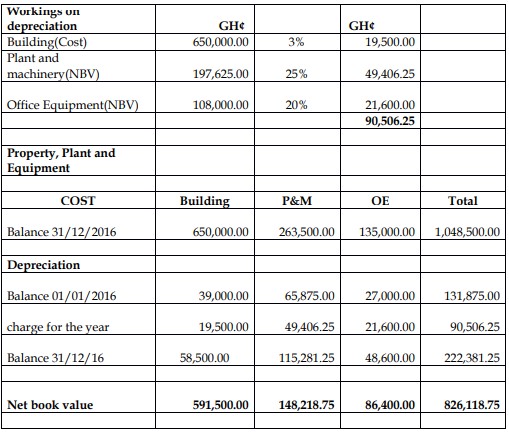

v) Interest on capital per annum is 15% and is yet to be recorded.

vi) Depreciation for the year ended 31 December 2016 has not been charged as follows:

- Building 3% per annum using the straight-line method.

- Office equipment 20% using the reducing balance method.

- Plant and machinery 25% using the reducing balance method.

Required:

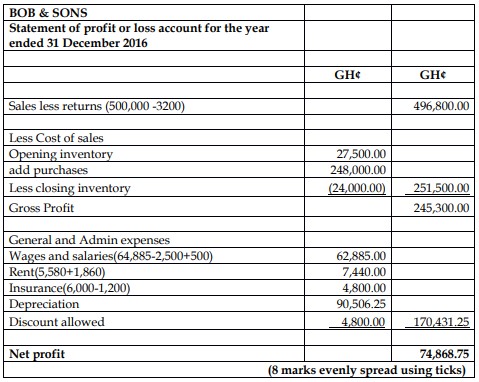

a) Prepare Bob & Sons’ Statement of Profit or Loss account for the year ended 31 December 2016. (8 marks)

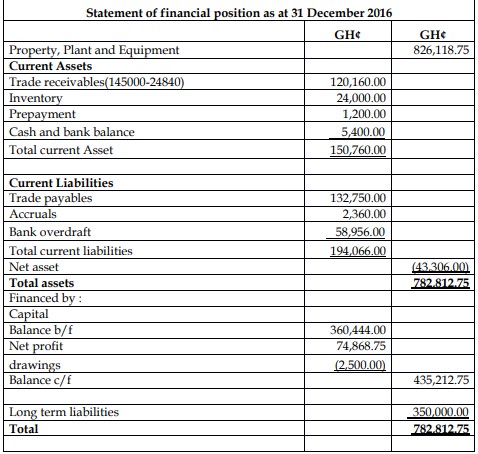

b) Prepare the Statement of Financial Position as at that date. (12 marks)

Answer

- Tags: Depreciation, Financial Statements, Sole Proprietorship

- Level: Level 1

- Uploader: Theophilus