- 20 Marks

Question

a) Cost-Volume-Profit (CVP) analysis is a way to find out how changes in variable and fixed costs affect a firm’s profit. Companies can use CVP to assess the impact on profit taking into consideration some assumptions.

Required:

State FIVE (5) assumptions underlying Cost-Volume-Profit Analysis. (5 marks)

b) The following data has been extracted from the operating records of Sharp Production Ltd:

| Year | Costs (GH¢) | Profit (GH¢) |

|---|---|---|

| 2019 | 402,000 | 54,000 |

| 2020 | 510,000 | 90,000 |

Required: i) Calculate the contribution/sales ratio for the company. (5 marks) ii) Compute the total fixed costs per annum. (5 marks) iii) Compute the sales value required to breakeven. (5 marks)

Answer

a) Assumptions underlying CVP Analysis:

- All costs can be conveniently segregated into fixed and variable elements.

- Total fixed costs remain constant while variable costs vary proportionately with the level of activity.

- The selling price per unit is given and remains constant over the relevant range of activity.

- All that is produced can be sold at the prevailing price.

- The only factor affecting costs and revenues is the volume of activity.

- Technology, production methods, and efficiency remain unchanged.

- There are no inventory level changes, or inventories are valued at marginal cost.

- There is no uncertainty.

- A single product or a constant product mix is produced and sold. (Any 5 points @ 1 mark each = 5 marks)

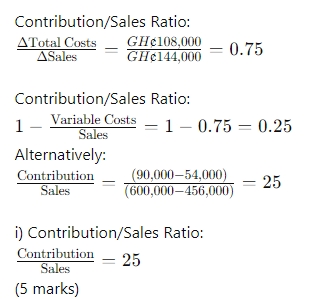

b) Workings:

| Year | Cost (GH¢) | Profit (GH¢) | Revenue (GH¢) |

|---|---|---|---|

| 2019 | 402,000 | 54,000 | 456,000 |

| 2020 | 510,000 | 90,000 | 600,000 |

| Revenue | Cost |

|---|---|

| High | 600,000 |

| Low | 456,000 |

| Change | 144,000 |

ii) Computation of Total Fixed Costs:

| Year | Revenue (GH¢) | TC (GH¢) | TVC (GH¢) | TFC (GH¢) |

|---|---|---|---|---|

| 2019 | 456,000 | 402,000 | 342,000 | 60,000 |

| 2020 | 600,000 | 510,000 | 450,000 | 60,000 |

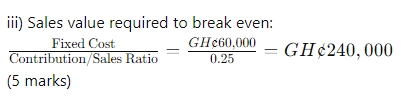

Alternatively: Using higher sales level: Contribution = 0.25 x GH¢600,000 = GH¢150,000 Profit = contribution – FC GH¢90,000 = GH¢150,000 – FC This implies FC = GH¢60,000 (5 marks)

- Uploader: Joseph