- 20 Marks

Question

BBT, a sole trader, prepared the following Trial Balance from his accounts on 30th September 2016.

| Dr (GHȼ) | Cr (GHȼ) | |

|---|---|---|

| Sales | 181,200 | |

| Sales returns | 1,810 | |

| Purchases | 79,310 | |

| Discounts received | 1,520 | |

| Carriage outwards | 420 | |

| Rent and rates | 30,800 | |

| Insurance | 780 | |

| Salaries | 20,400 | |

| Motor expenses | 6,200 | |

| General expenses | 7,450 | |

| Irrecoverable debts | 240 | |

| Allowance for receivables | 280 | |

| Drawings | 12,100 | |

| Loan interest | 600 | |

| 10% Loan | 8,000 | |

| Motor vehicles | 20,000 | |

| Accumulated depreciation for motor vehicles | 7,600 | |

| Equipment | 48,050 | |

| Accumulated depreciation for Equipment | 15,890 | |

| Inventory at 1st October 2015 | 6,200 | |

| Receivables | 15,000 | |

| Payables | 16,120 | |

| Bank | 1,250 | |

| Capital | 20,000 | |

| 250,610 | 250,610 |

The following information is also available: i) The closing inventory as at 30th September 2016 was valued at GHȼ6,480. At 30th September 2016, loan interest owing amounted to GHȼ200; rent owing was GHȼ450; whilst insurance was prepaid by GHȼ120. ii) BBT had included his son’s school fees of GHȼ1,400 in general expenses. iii) Receivables have been analysed as follows:

| GHȼ | |

|---|---|

| Current month | 8,000 |

| 30 to 60 days | 4,000 |

| 60 to 90 days | 2,000 |

| Over 90 days | 1,000 |

Allowance to be made for receivables is as follows:

30 to 60 days: 1%

60 to 90 days: 2.5%

Over 90 days 5%: (after writing off GHȼ500)

iv) One half of the 10% loan is repayable during the year ending 30th September

2016, and the balance after that date.

v) Depreciation is to be provided for as follows.

- Equipment: 10% per annum on cost using the straight line method. There were no additions or disposals during the year.

- Motor vehicles: 20% per annum by the reducing balance method. There were no additions or disposals during the year.

Required:

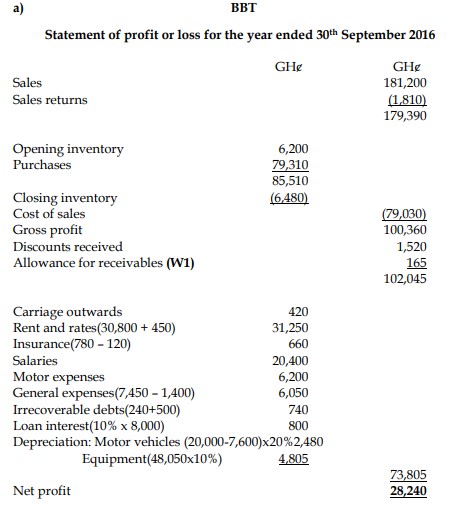

a) Prepare, for BBT, the Statement of profit or loss for the year ended 30th September 2016. (12 marks)

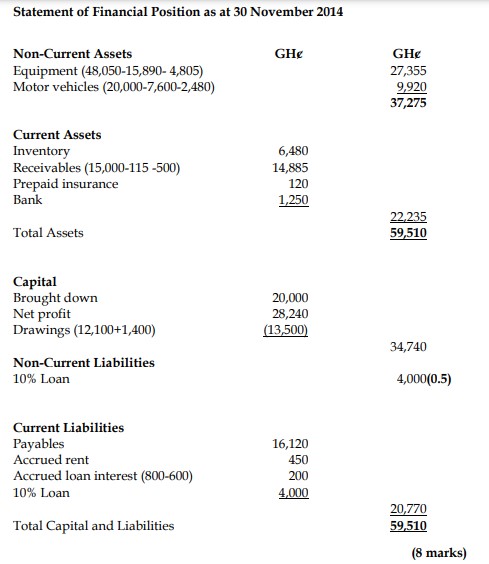

b) Prepare, for BBT, the Statement of Financial Position as at 30th September 2016. (8 marks)

Answer

Working (W1):

Allowance for receivables: Balance b/f: 280

Provision for the year [4,000 x 1% + 2,000 x 2.5% + (1,000 – 500) x 5%]: 115

Decrease in Allowance: 165

(12 marks)

- Tags: Financial Position, Profit and Loss Statement, Sole Trader, Trial Balance

- Level: Level 1

- Topic: Preparation of financial statements of a sole trader

- Series: NOV 2016

- Uploader: Theophilus