- 20 Marks

Question

a) FG Ltd is preparing its cash budget for January, February, and March 2020. Budgeted data are as follows:

| November | December | January | February | March | |

|---|---|---|---|---|---|

| Sales (Units) | 750 | 800 | 800 | 850 | 900 |

| Production (Units) | 800 | 800 | 850 | 900 | 950 |

| Direct labour & variable overhead incurred | GH¢48,000 | GH¢48,000 | GH¢51,000 | GH¢54,000 | GH¢57,000 |

| Fixed overhead incurred (excluding depreciation) | GH¢20,000 | GH¢20,000 | GH¢20,000 | GH¢20,000 | GH¢20,000 |

- The selling price per unit is GH¢200. The purchase price per kg of raw material is GH¢25. Each unit of finished product requires 2kg of raw materials which are purchased on credit in the month before they are used in production. Suppliers of raw materials are paid one month after purchase.

- All sales are on credit. 80% of customers pay one month after sale and the remainder pays two months after sale.

- The direct labour cost, variable overheads, and fixed overheads are paid in the month in which they are incurred.

- Machinery costing GH¢100,000 will be delivered in February and paid for in March.

- Depreciation, including that on the new machinery, is as follows:

- Machinery and equipment GH¢3,500 per month

- Motor vehicle GH¢800 per month

The opening cash balance on 1 January is estimated to be GH¢15,000.

Required:

i) Prepare a cash budget for each of the three months January, February, and March. (12 marks)

ii) State and explain FOUR (4) usefulnesses of cash budgets. (4 marks)

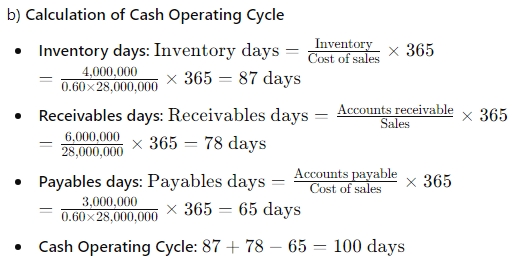

b) A company’s sales revenue for the year just ended was GH¢28 million. The company earned a gross margin of 40% on sales. All sales and purchases were on credit.

The following balances have been extracted from the year-end accounts:

- Inventory: GH¢4 million

- Accounts receivable: GH¢6 million

- Accounts payable: GH¢3 million

Required:

Calculate, to the nearest whole number, the company’s cash operating cycle based on the year-end figures. (4 marks)

Answer

Answer:

a)

i) Cash Budget for FG Ltd (January to March 2020)

| Month | January | February | March |

|---|---|---|---|

| Receipts | |||

| Credit sales (80% previous month) | 128,000 | 128,000 | 136,000 |

| Credit sales (20% two months ago) | 30,000 | 32,000 | 32,000 |

| Total Receipts | 158,000 | 160,000 | 168,000 |

| Payments | |||

| Purchases | 42,500 | 45,000 | 47,500 |

| Labour & overheads | 71,000 | 74,000 | 76,000 |

| Machinery | – | – | 100,000 |

| Total Payments | 113,500 | 119,000 | 223,500 |

| Net Cash Flow | 44,500 | 41,000 | (55,500) |

| Opening Balance | 15,000 | 59,500 | 100,500 |

| Closing Balance | 59,500 | 100,500 | 45,000 |

| (12 marks evenly spread using ticks) |

ii) Usefulness of Cash Budgets

- Cash Flow Management: Helps in managing cash flows by providing a forecast of cash inflows and outflows, ensuring that the company has sufficient cash to meet its obligations.

- Decision Making: Assists management in making critical decisions, such as arranging for additional financing or investing surplus cash.

- Planning: Enables planning for future cash needs, such as major expenditures or expansion plans.

- Control: Provides a benchmark against which actual cash flows can be compared, allowing for monitoring and control of cash flows.

(Any 4 points for 1 mark each) (4 marks)

- Tags: Cash Budget, Cash Flow, Cash Operating Cycle, Receipts and Payments

- Level: Level 1

- Topic: Cash Budgeting and Working Capital

- Series: NOV 2020

- Uploader: Joseph