- 20 Marks

Question

a) Explain the terms break-even point and margin of safety as used in cost-volume-profit (CVP) analysis in short term decision making. (4 marks)

b) Kack Ltd is a company which uses cost-volume-profit analysis for planning and control decisions. You have been given the following information for the just ended operational period:

| Description | Amount (GH¢) |

|---|---|

| Total revenue | 3,600,000 |

| Total cost | 3,510,000 |

| Variable cost | 2,700,000 |

Required:

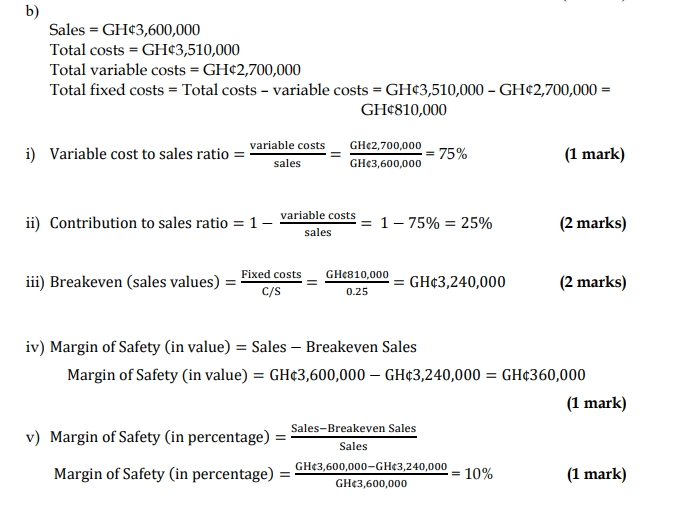

i) Variable cost/sales ratio. (1 mark)

ii) Contribution/sales (C/S) ratio. (2 marks)

iii) Break-even sales (in value). (2 marks)

iv) Margin of safety (in value). (1 mark)

v) Margin of safety (in percentage). (1 mark)

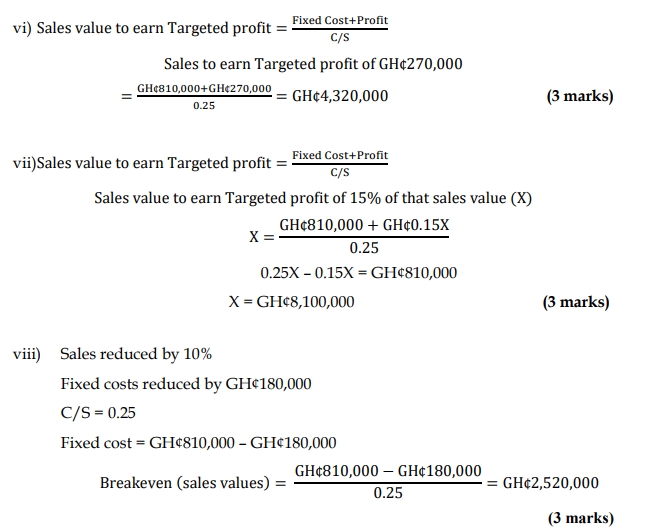

vi) The sales value which would yield a profit of GH¢270,000 assuming the C/S ratio and fixed costs remain unchanged. (3 marks)

vii) The sales value which would yield a profit of 15% of that sales value assuming the C/S ratio and the fixed costs remain unchanged. (3 marks)

viii) The break-even sales value if total fixed costs are reduced by GH¢180,000 while the selling price is reduced by 10%, assuming no changes in variable costs ratio. (3 marks)

Answer

a) Break-even Point (BEP): The level of sales at which total revenue equals total costs, resulting in no profit or loss. It is the point where the company covers all its fixed and variable costs.

Margin of Safety (MoS): The difference between actual or budgeted sales and the break-even sales level. It represents the extent to which sales can drop before the company incurs losses.

b)

| Description | Calculation | Result (GH¢) |

|---|---|---|

| Sales | 3,600,000 | |

| Total costs | 3,510,000 | |

| Variable costs | 2,700,000 | |

| Fixed costs | 3,510,000 – 2,700,000 | 810,000 |

- Tags: Break-even Analysis, Margin of Safety, Sales Target

- Level: Level 1

- Topic: Cost-Volume-Profit (CVP) Analysis

- Series: NOV 2020

- Uploader: Joseph