- 20 Marks

Question

Agyakoo is a vehicle spare parts dealer in Aboisokai. He deposits his cash takings into his bank account after retaining GH¢2,000 per week for personal use and paying wages and other expenses. For the accounting period ending 31st December 2014, the following expenses were noted:

| Description | GH¢ |

|---|---|

| Staff wages | 1,440 |

| Cleaning | 1,200 |

| Sundry | 5,000 |

| Telephone | 600 |

| Rent | 10,000 |

| Electricity | 500 |

| Accountancy fees | 750 |

The following are his bank transactions:

| Description | GH¢ |

|---|---|

| Income Tax | 3,000 |

| Telephone | 600 |

| Bank Lodgments: | |

| Cash Sales | 30,100 |

| Bulk Sales (Cheques) | 95,000 |

| Treasury bill Interest | 5,000 |

| Payments to Suppliers | 110,000 |

| Rent | 10,000 |

| Electricity | 500 |

| Balance as at 1st January 2014 | 6,000 |

Additional Information:

| 01/01/2014 | 31/12/2014 | |

|---|---|---|

| Furniture & Fittings | 1,200 | 1,100 |

| Stocks in Trade | 10,500 | 7,650 |

| Payables – Goods Purchased | 1,670 | 2,750 |

| Payables – Rent | 5,000 | 6,000 |

| Payables – Electricity | 500 | 650 |

| Payables – Telephone | 150 | 200 |

| Accountancy Fee | – | 750 |

| Treasury Bills | 10,000 | 10,000 |

| Receivables – Bulk Sales | 8,000 | 15,000 |

You are required to:

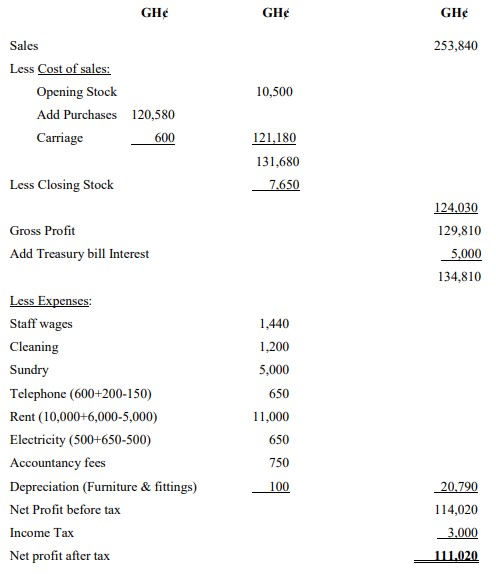

i. Prepare an Income Statement for the year ending 31st December 2014. (10 marks)

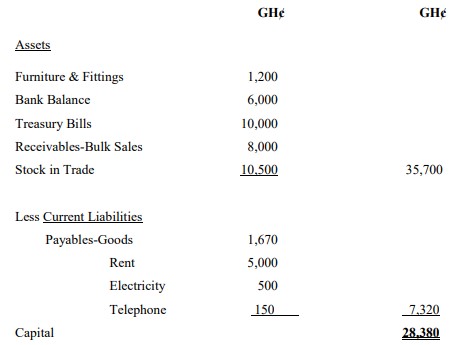

ii. Prepare a Statement of Affairs as at 1st January 2014. (2 marks)

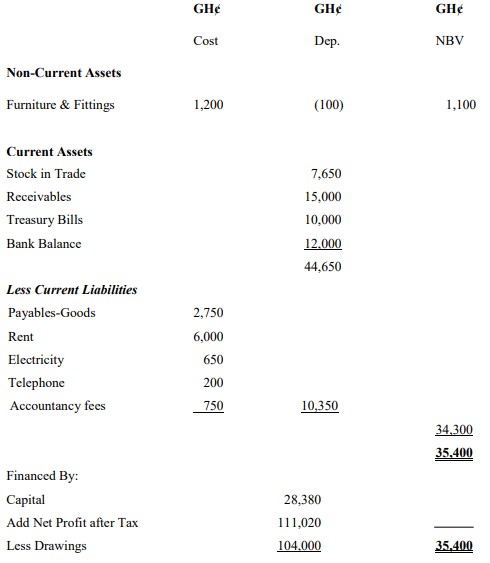

iii. Prepare a Statement of Financial Position as at 31st December 2014. (8 marks)

Answer

i. Income Statement for the year ending 31st December 2014

ii. Statement of Affairs as at 1st January 2014

iii. Statement of Financial Position as at 31st December 2014

- Uploader: Theophilus